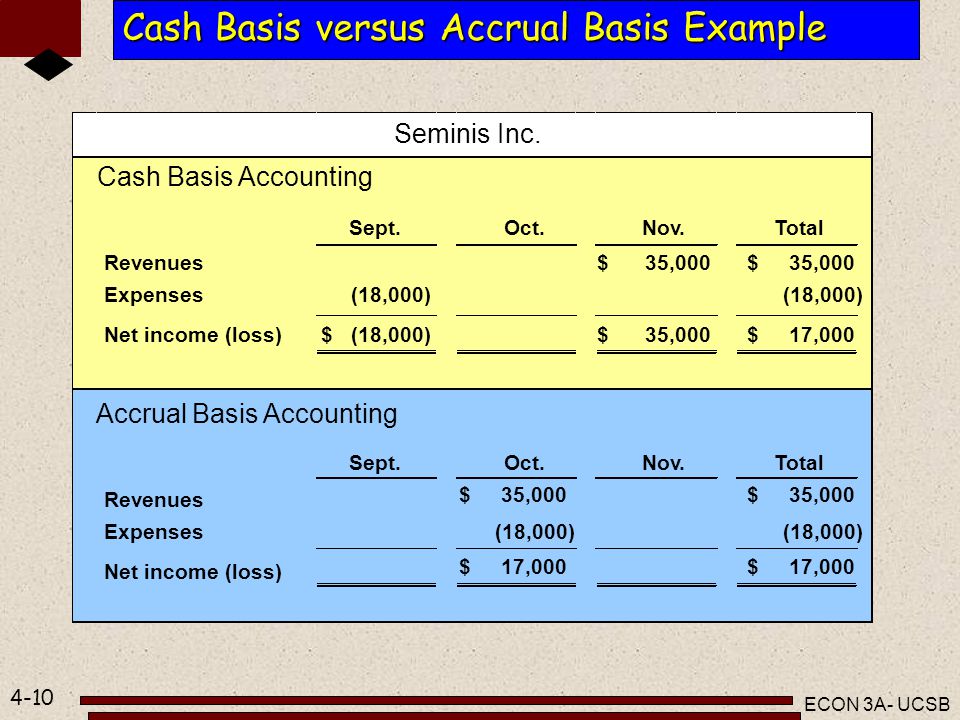

Cash Vs Accrual Accounting Journal Entries . Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. What is cash basis accounting? The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Cash vs accrual basis of accounting are two methods of recording transactions for a business. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Under the cash method of accounting. Accrual accounting recognizes revenue when it’s. The major differences between cash and accrual accounting come down to three factors: What is accrual basis accounting?

from www.simple-accounting.org

The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Cash vs accrual basis of accounting are two methods of recording transactions for a business. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. What is accrual basis accounting? Under the cash method of accounting. What is cash basis accounting? Accrual accounting recognizes revenue when it’s. Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. The major differences between cash and accrual accounting come down to three factors:

Accrual Accounting vs. Cash Basis Accounting What's the Difference

Cash Vs Accrual Accounting Journal Entries What is accrual basis accounting? The major differences between cash and accrual accounting come down to three factors: What is cash basis accounting? The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Under the cash method of accounting. Accrual accounting recognizes revenue when it’s. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Cash vs accrual basis of accounting are two methods of recording transactions for a business. What is accrual basis accounting?

From www.educba.com

Accrual Accounting Examples Examples of Accrual Accounting Cash Vs Accrual Accounting Journal Entries The major differences between cash and accrual accounting come down to three factors: What is accrual basis accounting? The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Cash vs accrual basis of accounting are two methods of recording transactions for a business. What is cash basis accounting? Accrual accounting. Cash Vs Accrual Accounting Journal Entries.

From opentext.ku.edu

Chapter 9 Accounting and Cash Flow Small Business Management Cash Vs Accrual Accounting Journal Entries Cash vs accrual basis of accounting are two methods of recording transactions for a business. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. The major differences between cash and accrual accounting come down to three factors: The difference between cash and accrual accounting lies in the timing of when sales. Cash Vs Accrual Accounting Journal Entries.

From www.svtuition.org

How to Convert Accrual to Cash Basis Accounting Accounting Education Cash Vs Accrual Accounting Journal Entries The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Accrual accounting recognizes revenue when it’s. Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. What is accrual basis accounting? What is cash basis accounting? The major differences between. Cash Vs Accrual Accounting Journal Entries.

From www.enkel.ca

Cash vs. Accrual Accounting What is the Difference? Enkel Cash Vs Accrual Accounting Journal Entries Cash vs accrual basis of accounting are two methods of recording transactions for a business. Accrual accounting recognizes revenue when it’s. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. The major differences between cash and accrual accounting come down to three factors: What is cash basis accounting? Under the cash. Cash Vs Accrual Accounting Journal Entries.

From www.ravitinsights.com.au

Cash Accounting vs Accrual Accounting Ravit Insights Cash Vs Accrual Accounting Journal Entries Cash vs accrual basis of accounting are two methods of recording transactions for a business. Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Under the cash method of accounting. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Accrual. Cash Vs Accrual Accounting Journal Entries.

From onlinenotesnepal.com

Cash versus accrual basis of Accounting Accrual Accounting and Cash Vs Accrual Accounting Journal Entries Cash vs accrual basis of accounting are two methods of recording transactions for a business. Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Accrual accounting recognizes revenue when. Cash Vs Accrual Accounting Journal Entries.

From www.youtube.com

3.1 Accrual vs Cash Basis Accounting YouTube Cash Vs Accrual Accounting Journal Entries Under the cash method of accounting. What is accrual basis accounting? Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Accrual accounting recognizes revenue when it’s. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. The first difference. Cash Vs Accrual Accounting Journal Entries.

From ebetterbooks.com

Cash Vs Accrual Accounting Hard] eBetterBooks Cash Vs Accrual Accounting Journal Entries Under the cash method of accounting. The major differences between cash and accrual accounting come down to three factors: What is cash basis accounting? Cash vs accrual basis of accounting are two methods of recording transactions for a business. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. Accrual. Cash Vs Accrual Accounting Journal Entries.

From www.slideshare.net

19.1 Cash vs accrual accounting Cash Vs Accrual Accounting Journal Entries What is accrual basis accounting? The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Accrual accounting recognizes revenue when it’s. What is cash basis accounting? The major differences between cash and accrual accounting come down to three factors: Under the cash method of accounting. Cash vs accrual basis of accounting are. Cash Vs Accrual Accounting Journal Entries.

From www.youtube.com

Difference between Cash and Accrual Basis of Accounting YouTube Cash Vs Accrual Accounting Journal Entries The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. The major differences between cash and accrual accounting come down to three factors: Cash vs accrual basis of accounting are two methods of recording transactions for a business. What is accrual basis accounting? The difference between cash and accrual accounting lies in. Cash Vs Accrual Accounting Journal Entries.

From www.youtube.com

Why Cash Accounting is MISLEADING!! Accrual vs. Cash Accounting Cash Vs Accrual Accounting Journal Entries The major differences between cash and accrual accounting come down to three factors: Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Accrual accounting recognizes revenue when it’s. The difference between. Cash Vs Accrual Accounting Journal Entries.

From marketbusinessnews.com

What is an accrual? Difference between acrrual accounting and cash Cash Vs Accrual Accounting Journal Entries The major differences between cash and accrual accounting come down to three factors: Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. What is cash basis accounting? Under the cash method of accounting. The difference between cash and accrual accounting lies in the timing of when sales and purchases. Cash Vs Accrual Accounting Journal Entries.

From www.personal-accounting.org

CashBasis Accounting Definition Personal Accounting Cash Vs Accrual Accounting Journal Entries The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Accrual accounting recognizes revenue when it’s. What is accrual basis accounting? Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. The difference between cash and accrual accounting lies in the timing. Cash Vs Accrual Accounting Journal Entries.

From khatabook.com

Accrued Expenses Journal Entry How to Record Accrued Expenses With Cash Vs Accrual Accounting Journal Entries Cash vs accrual basis of accounting are two methods of recording transactions for a business. What is accrual basis accounting? The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. The major. Cash Vs Accrual Accounting Journal Entries.

From db-excel.com

Expense Accrual Spreadsheet Template for Accrual Versus Cashbasis Cash Vs Accrual Accounting Journal Entries Accrual accounting recognizes revenue when it’s. What is accrual basis accounting? What is cash basis accounting? The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. Cash vs accrual basis of accounting. Cash Vs Accrual Accounting Journal Entries.

From www.slideshare.net

14.1 Cash vs Accrual accounting Cash Vs Accrual Accounting Journal Entries The major differences between cash and accrual accounting come down to three factors: Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Cash vs accrual basis of accounting are two methods of recording transactions for a business. Accrual accounting recognizes revenue when it’s. What is cash basis accounting? The. Cash Vs Accrual Accounting Journal Entries.

From businesswalls.blogspot.com

Difference Between Cash And Accrual Reporting For A Business Business Cash Vs Accrual Accounting Journal Entries The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your. What is cash basis accounting? Cash vs accrual basis of accounting are two methods of recording transactions for a business. Under the cash method of accounting. The first difference between cash accounting and accrual accounting is the time when transactions. Cash Vs Accrual Accounting Journal Entries.

From 1investing.in

Accruals Definition India Dictionary Cash Vs Accrual Accounting Journal Entries Cash accounting reflects business transactions on a company’s financial statements when the cash flows into or out of the business. Cash vs accrual basis of accounting are two methods of recording transactions for a business. The first difference between cash accounting and accrual accounting is the time when transactions are recorded (when revenue. What is cash basis accounting? Accrual accounting. Cash Vs Accrual Accounting Journal Entries.